Exploring Perspectives: Insights from our UK Survey on Energy Saving Tools and Devices

At Quarta, we’re committed to understanding how people feel about energy-saving products and sustainability. To gain valuable insights, we conducted a survey across the UK in collaboration with YouGov. With 860 participants answering our questions, we aimed to shed light on consumer attitudes towards energy efficiency. Anyone can join YouGov to share their opinions and earn rewards. You can sign up and participate in surveys and influence important decisions while earning rewards for your valuable opinions. Our study, conducted in April 2024, explored various demographics, including income, house type, education level, and interest in sustainability. Prior research has suggested a correlation between higher income levels, education, and interest in renewable energy. Let’s explore into the methodology behind our survey and uncover the top three findings.

Our survey was conducted in collaboration with YouGov, a leading research firm, renowned for its nationwide surveys. We carefully selected a diverse group of 860 participants from across the UK. Participants were chosen based on factors such as income, house type, education level, and their interest in sustainability.

Methodology

We examined individuals falling within the medium and high-income brackets, including those earning between 75% and 200% of the median income, as well as those surpassing 200% of the median income. Additionally, we focused on respondents who previously expressed agreement with statements such as “I am willing to pay more for sustainable energy,” “I consider myself an environmentalist,” “I would consider getting solar panels for my home,” and “I think green energy is the future.” We also targeted individuals who embrace technology and agreed with the statement “Technology changed my life for the better.” Furthermore, our analysis included homeowners, both with and without mortgages, residing in detached, semi-detached, or terraced houses. The survey, administered on April 23, 2024, aimed to assess public sentiment towards energy-saving products and sustainability initiatives. Through a series of questions, we aimed to uncover valuable insights into consumer preferences and behaviours regarding energy efficiency.1. Drivers of Interest in Renewable Energy

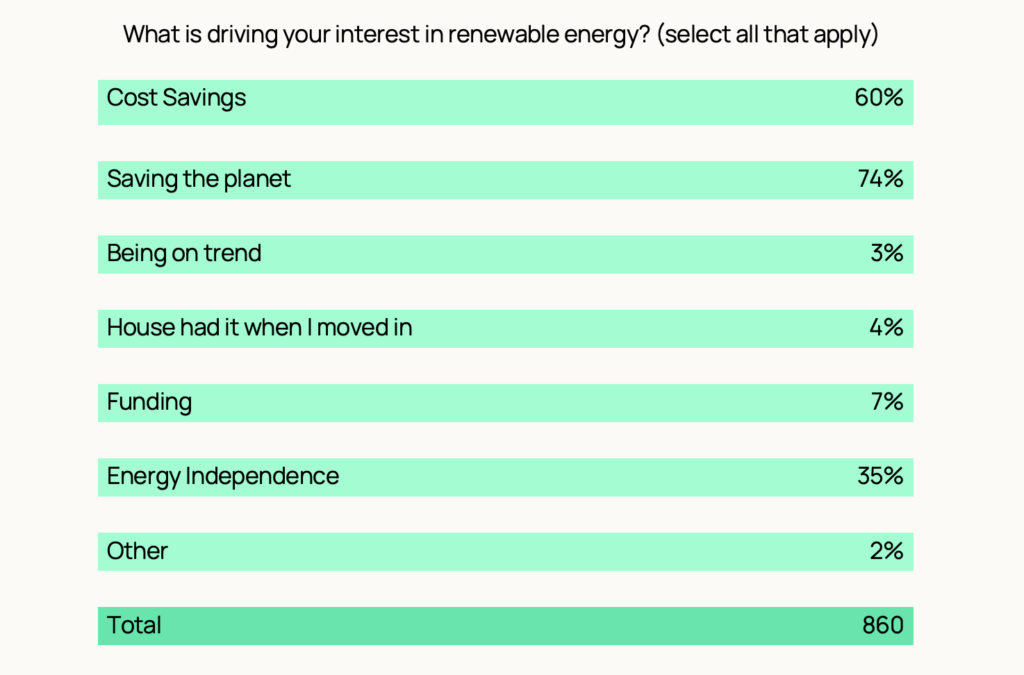

When participants were asked about the factors motivating their interest in renewable energy, several key themes emerged. Among the respondents, 60% chose cost savings as a primary driver, indicating a significant emphasis on the financial benefits of renewable energy solutions. Furthermore, a substantial 74% highlighted environmental concerns, expressing a strong commitment to sustainability and the preservation of the planet. Only a small minority, comprising 3%, identified the trendiness of renewable energy adoption as a motivating factor. Additionally, 4% of respondents reported their decision being influenced by the presence of renewable energy infrastructure already installed in their homes upon moving in. A modest 7% mentioned access to funding as a factor driving their interest, while 35% emphasised the importance of energy independence. Lastly, 2% of respondents cited other reasons such as a lack of interest in conventional energy sources, a focus on efficiency, and a desire to address climate change impacts in less developed regions. These varied perspectives underscore the complexity of motivations driving interest in renewable energy.

2. Uses of Renewable Energy

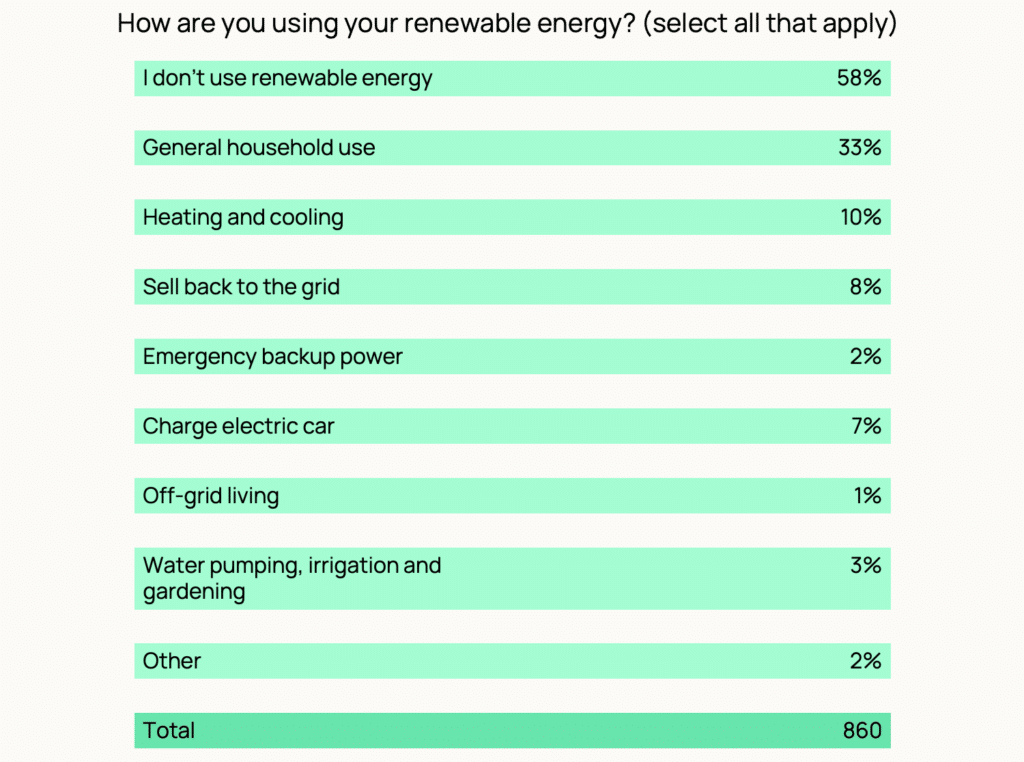

Responses to the question regarding the utilisation of renewable energy revealed a range of applications. While a significant portion (58%) reported not using renewable energy at all, among those who did, the most common use was for general household purposes (33%). Additionally, a notable percentage allocated renewable energy for heating and cooling (10%), selling back to the grid (8%), emergency backup power (7%), and charging electric vehicles (7%). Other applications included off-grid living (1%), water pumping, irrigation, and gardening (3%), as well as various other uses (2%). These findings illustrate the multifaceted ways in which individuals incorporate renewable energy into their lifestyles.

3. Top Energy-Saving Tools and Devices

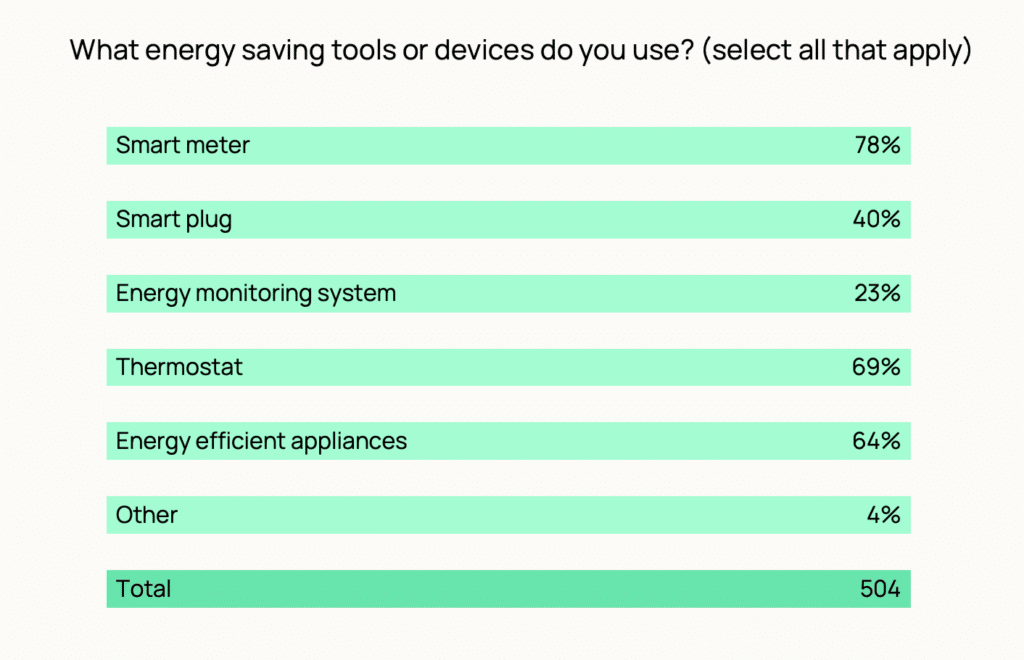

When asked, “What energy-saving tools and devices do you use?” respondents provided insights into their adoption of various technologies aimed at reducing energy consumption. Among the most popular choices were smart meters, with a significant 78% of participants indicating their use. Additionally, thermostats proved to be widely utilised, with 69% of respondents reporting their deployment. Energy-efficient appliances were also prevalent, selected by 64% of participants. Other notable options included smart plugs (40%) and energy monitoring systems (23%). These findings underscore the importance of technological solutions in promoting energy efficiency practices among consumers.

In conclusion, our survey has provided invaluable insights into the perceptions and attitudes of UK residents towards energy-saving products. We’ve gained a deeper understanding of consumer preferences and behaviours in this space. As we continue our journey towards a more sustainable future, these findings will serve as a cornerstone for developing innovative solutions that resonate with consumers’ needs and aspirations. Stay tuned for more insights from Quarta as we strive to empower individuals and communities to embrace energy efficiency and sustainability.